The Index Effect: The Trade Desk to Join the S&P 500

Four key benefits and three real risks of inclusion

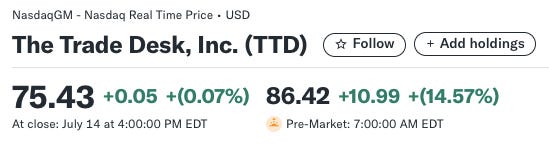

On Monday afternoon, July 14, S&P Dow Jones Indices announced that The Trade Desk TTD 0.00%↑, currently a 37.5% position and the largest holding in the Sycamore portfolio, will be added to the S&P 500 effective Friday, July 18. The stock is trading up roughly 14% in the pre-market following the news.

Shoutout to the handful of other owners here on Substack doing great work covering this business:

, , ,Here is what Jeff Green, CEO of The Trade Desk had to say in response:

“When we founded The Trade Desk 16 years ago, and when we went public 9 years ago, I didn’t dare dream that we would be an S&P 500 component. It says so much about the incredible work and innovation of every TTDer present and past. It says so much about every client and every partner who stuck with us and trusted us and saw the value of programmatic and the value of objectivity. And the most exciting thing about all of this? We’re just getting started.”

This is the first time I’ve held a company at the time of its inclusion in the S&P 500, and so with that context, I started digging into what the inclusion actually means. So, below are four key benefits and three real risks of inclusion.

Key Benefits of S&P 500 Inclusion

1.) Significant Passive Fund Inflows

Inclusion in the index forces passive investment funds to buy the stock in order to mirror the S&P 500’s composition. Roughly $15 trillion is benchmarked to the S&P 500, with an estimated $7 trillion directly indexed to it through mutual funds, ETFs (like SPY, IVV, and VOO), pensions, and other passive strategies. In effect, billions of dollars of assets that track the S&P 500 must now hold the newly added company’s shares, creating automatic demand for the stock. This often translates to a substantial one-time inflow of capital as index funds rebalance their portfolios to include the new entrant. Hence the +14% pre-market move this morning.

2.) Enhanced Liquidity

As index funds and a broader base of investors transact in the stock, trading volume typically increases and bid-ask spreads tighten, improving liquidity. Greater liquidity can make it easier for large investors to enter or exit positions without significantly moving the price.

3.) Prestige and Visibility

Joining the S&P 500 is often seen as a stamp of approval, signaling that a company has achieved a certain scale and stability in its business. It raises the firm’s profile on Wall Street and in the media, since many market participants benchmark against the S&P 500. Inclusion can improve overall investor sentiment, as it is sometimes interpreted as validation of the company’s financial strength and growth prospects. Additionally, S&P 500 companies tend to receive broader analyst coverage and greater interest from large institutional investors, which can further bolster the company’s standing. In short, membership in this elite index enhances the company’s credibility and name recognition.

4.) Potential Valuation Uplift

The combination of forced buying and increased demand often provides a short-term boost to the stock’s valuation. Share prices frequently rise upon news of inclusion, which can benefit existing shareholders and even the company’s ability to raise capital. With a higher stock price and more liquid shares, a company might find it easier to finance growth (for example, through secondary stock offerings or using stock as acquisition currency) at favorable terms, although the former is not necessary for TTD. In effect, index inclusion can lower the cost of capital over time for the company. Moreover, being part of the S&P 500 can place the stock on the radar of conservative investors and fiduciaries (pensions, endowments, etc.) that restrict investments to major index constituents, potentially expanding the shareholder base.

Potential Risks of Major Index Inclusion

1.) Short-Term Volatility Around Rebalancing:

In the days around the effective date of inclusion, trading volume in the stock will spike dramatically as index funds complete their purchases. This concentrated trading activity can lead to wild price swings in a short period. Investors should be prepared for unusually high volatility and liquidity imbalances around the inclusion date – not only on the upside but potentially on the downside if, for instance, some look to take profits after the index funds have finished buying. At first glance, this looks to be the case with DataDog from just a week ago. Once the stock is in the index, its price may also become more correlated with index-wide movements (since it will be held by passive funds), meaning broader market volatility can affect it more directly.

2.) Heightened Scrutiny and Expectations

Being in the S&P 500 puts a company under a brighter spotlight. Analysts, institutional investors, and the media pay closer attention to S&P 500 companies, which can be a double-edged sword. On one hand, more coverage is good, but on the other, any missteps (earnings misses, bad news, etc.) will be amplified. There is also the oversight from index committees – for instance, S&P 500 companies are expected to maintain certain standards (including financial viability). While a company won’t be removed for one bad quarter, consistent deterioration or major controversies could invite calls for removal, which would be a reputational hit. In short, executives may feel pressure to prioritize short-term results to “justify” their place in the index, which could influence corporate decisions.

3.) Overvaluation and Mean Reversion Risk

The surge in stock price from index inclusion can sometimes overshoot the company’s fundamental value, at least in the short term. Index-driven buying is not based on fundamentals – it’s mechanical. This can lead to the stock trading at a premium that might not be sustainable once the one-off buying is done. Some academic and industry studies have noted that companies added to the S&P 500 tend to underperform the index in the year after inclusion. In other words, the inclusion pop can be a “buy high” phenomenon for index funds and, after the dust settles, the stock’s returns may normalize or even lag if the inclusion hype fades. Investors should therefore be careful about chasing a stock just because it’s added to the index. Additionally, once the stock is in the index, its valuation could be influenced by index fund flows. Being part of a major index increases the stock’s exposure to macro-index movements, which can be a downside if not aligned with the company’s fundamentals.

I hope this was insightful for you as doing this research was certainly helpful for me.

Thanks for reading,

Matthew Blake

Founder & CIO | Sycamore Capital Management, LLC

Disclaimer: Sycamore Capital Management, LLC (referred to in some materials as “Sycamore” or “Sycamore Capital”) is a research and publishing platform provided for informational purposes only. Nothing published by Sycamore Capital Management, LLC or its author constitutes investment advice or a recommendation to buy, sell, or hold any security. The company is not a registered investment advisor and does not manage client assets or offer personalized financial advice. All opinions expressed are solely those of the author, and any securities referenced reflect personal holdings at the time of publication unless otherwise stated. Readers are solely responsible for their own investment decisions and are encouraged to conduct independent research and consult with a licensed financial advisor before acting on any information provided.

Spot on, and TTD is now more than 100% from the April lows. Great work

Thanks for the shout-out! My only regret is not having more of it.