Re-Underwriting After a 40% Collapse | The Trade Desk Q2 2025 Earnings Recap

An earnings recap + deep dive into the business + re-underwriting my thesis after a brutal 40% collapse

“We've proven time and again that our alignment with advertisers, our focus on innovation and our commitment to transparency and objectivity sets us apart. And with the upgrades we've made across our company, our platform and our partnerships, I'm more confident than ever that The Trade Desk will continue to capture more than our fair share of this growing market.”

Jeff Green, CEO

There is a lot to like about The Trade Desk, contrary to current belief. I’ve written about it before a good bit. But following a sharp 39% single day sell-off in a stock that has become a core Sycamore holding, I had to step back and re-underwrite my thesis.

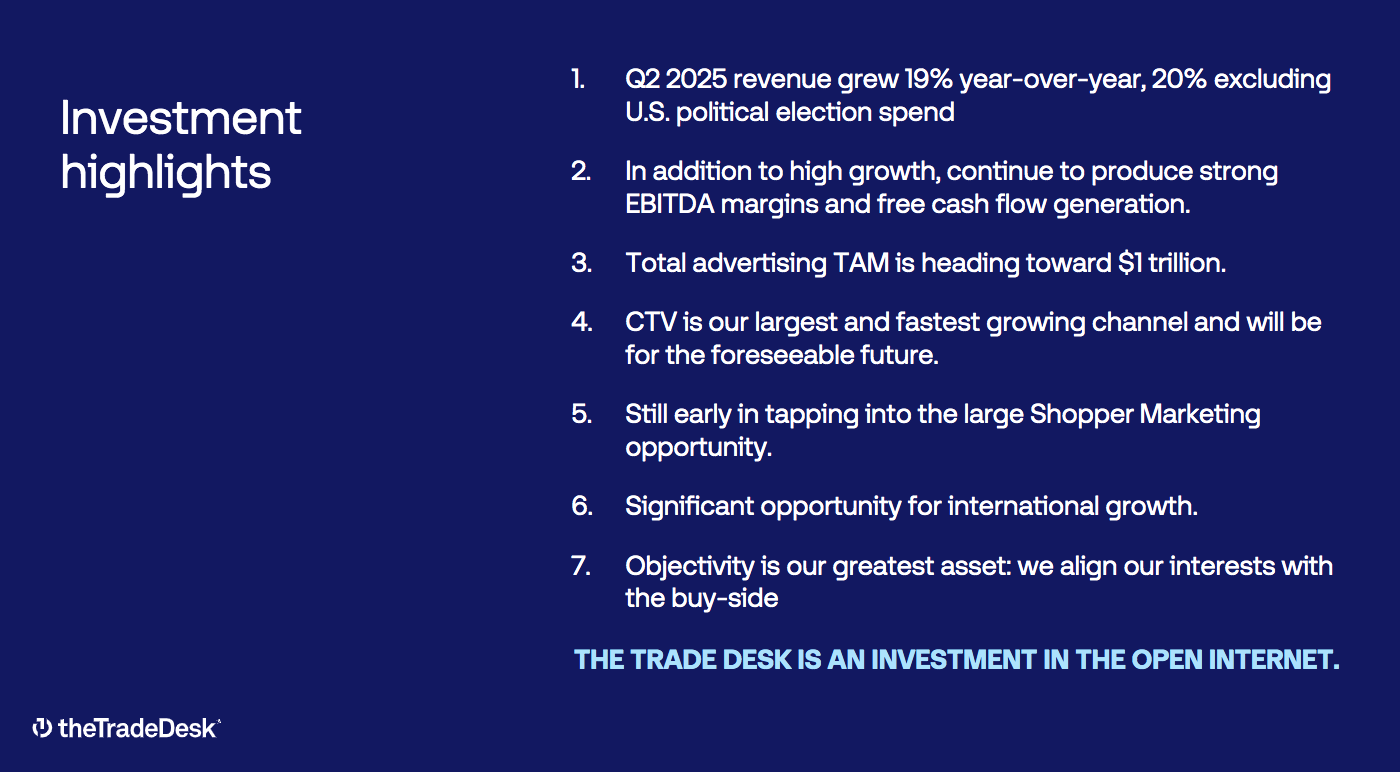

This is a high quality company with a top-rated technology platform that is driving real customer outcomes in the programmatic ad-tech space. The company has deep customer relationships and partnerships, multiple growth levers, a strong innovation pipeline, a visionary founder-CEO that has consistently been proven right when the industry and market says he is wrong, a very clean financial profile, and ultimately, a business model that is objectively aligned with the interests of its customers (contrary to its competitors).

While there are questions that need to be considered and studied following the Q2 earnings report, when you zoom out and look at the 30,000 foot view, you find a company executing against a strategic vision and growing tremendously in its short lifetime. But too often, Wall Street gets lost in the weeds of this quarter or next, missing the big picture phase shift happening right before its eyes.

Watching Wall Street waver on this name back and forth over the past three quarters reminds me of how Brad Gerstner described his bet on Priceline in the Fall of 2008. Here is what he had to say about that investment:

“As investors, we often take what we call this private equity approach to the public markets, which is, you know, let’s get the big trends, the phase shifts, the super-cycles right. You had me over to Benchmark years ago, and you said, ‘Brad, will you come and talk about Booking.com and the case you do at Columbia Business School in the old Graham and Dodd class that I teach with Chris Begg on occasion?’

And the thing I tried to teach the students in that class [was] why did all the analysts on Wall Street miss Booking.com, right? Miss Priceline? Now, remember, Priceline was a billion-dollar company in the public markets; today it’s $120 billion, a 120-bagger in the public markets. I mean, there aren’t many venture capitalists that ever get a 120-bagger, let alone a public market investor.

And the takeaway in the class is: everybody, all the analysts on Wall Street, were so focused on how many hotels [was the company] going to add in the quarter. Right? There’d be a lot of volatility around the number of hotels added in the quarter. Nobody really took the time horizon to say, in five, ten, fifteen years, how much more of the offline world is going to book their hotels online and how much bigger that’s going to be.

So often…they would get the long-term conviction right, but they would end up trading out of the position.”

Brad Gerstner, Altimeter (BG2 Podcast Ep. 3)

Ad spend moving online and being transacted programmatically is one of those generational phase shifts. TTD has been executing nearly flawlessly against a vision to capture the lion’s share of a $1 trillion, and growing, annual ad spend market.

“Global advertising is a trillion-dollar industry today, and that TAM is all up for grabs.”

Jeff Green, CEO

While Wall Street sold the stock off sharply following the earnings print, Q2 was still a very good/strong quarter. Nonetheless, there are some questions that need to be addressed, namely,

Are competitors like Amazon beginning to take share from TTD?

Does the sudden CFO departure carry deeper implications?

Was the sell-off simply a valuation reset on decelerating growth?

Is premium content consolidating behind walled gardens, threatening the open internet model?

Are margins at risk from competitors undercutting on price?

I have spent countless hours working on everything below and if TTD is a name you’re interested in, I hope you find it helpful!

Overview of Q2 2025 Performance

Revenue: $694 million, +18.7% Y/Y

GAAP Net Income: $90 million, +5.9% Y/Y

GAAP Diluted EPS: $0.18, +5.9% Y/Y

Non-GAAP Diluted EPS: $0.41, +13.9% Y/Y

Adjusted EBITDA: $271 million, +12.0% Y/Y

Adjusted EBITDA Margin: 39% (vs. 41% in Q2 2024)

Free Cash Flow: $119 million, +102.7% Y/Y

Free Cash Flow Margin: 17.3%, +71.3% Y/Y

Return on Invested Capital: 25.8%

Cash, Equivalents, & Short-Term Investments: $1.7 billion

Debt: $0

Share Repurchases: $261 million in Q2; $375 million remaining under authorization

Customer Retention: >95% for the 11th consecutive year

TTD shareholders take this for granted. But when there are articles out there saying “Top analyst on concerns over the Trade Desk's dwindling clients,” this data point becomes a really valuable marker.

Business & Segment Highlights

CTV Leadership

CTV advertising remains TTD’s fastest-growing channel, with no signs of slowing down. The company noted that CTV-driven spend accounted for a high-40s % of overall business in Q2 2025, making it the largest segment on the platform. Major streaming partners such as Disney, NBCUniversal, Roku, Netflix, and Walmart’s media arm deepened their relationships with TTD during the quarter, as more premium video content became available programmatically on the open internet.

Retail Media and Data

Outside of CTV, TTD highlighted retail media as another high-growth area. The platform’s integrations with retailers and e-commerce data are driving advertising spend that can be tied to real purchase outcomes. The company expanded partnerships with retail and commerce players like Instacart (to enable grocery audience targeting) and Ocado, providing advertisers with more granular purchase data for measurement.

“Unlike others in the market, our goal is to drive the use of retail data across as many advertiser campaigns as possible. We do not compete with retailers and only an independent objective partner like us can truly help advertisers unlock this opportunity. In Q2, a record amount of spend was influenced by retail data both on our platform and on the Walmart DSP as more shopper marketing budgets flow into programmatic.”

Jeff Green, CEO

Vertical Performance

Ad spend growth was broad-based, though Home & Garden (8% of revenue) and Style/Fashion (4%) lagged in Q2. Large-brand sectors like auto and CPG were also pressured by tariffs, with Jeff Green noting many of TTD’s biggest clients in those categories are feeling the impact. This point has been made in many CPG company earnings calls this quarter. Importantly, TTD’s focus on big global advertisers and brands means short-term macro pressures in those sectors can impact its growth. However, management views this client mix as a long-term positive, expecting spend to rebound as conditions normalize. It’s also a lot easier to go downstream from the largest brands in the world to SMBs than it is to go upstream from SMBs to large brands. Management noted on the call that they will eventually move downstream, but for now the opportunity with largest players remains their priority.

JBP Growth

TTD continues to strengthen its direct relationships with major brands and their agencies through joint business plans.

“The number of live JBPs is at an all-time high, and we continue to see spend under JBPs significantly outpace the rest of our business. What's even more encouraging is the strength of our JBP pipeline with nearly 100 JBPs in progress, many of them in the late stages of development. And while many of our JBPs are signed directly with brands, we are working hand in hand with their agencies almost in every case to bring these partnerships to life.”

Jeff Green, CEO

The strong >95% client retention and expanding JBP pipeline illustrate the stickiness of TTD’s offering among top-tier advertisers and the strength of their relationships with brands and agencies.

Geographic Mix

TTD’s revenue remains primarily North American, but international markets are becoming a bigger contributor. In Q2, about 14% of spend came from international clients. International spend grew at a higher rate than domestic spend. Management sees substantial room for growth abroad, noting that roughly 60% of global ad spend happens outside the U.S., whereas the vast majority of TTD’s current business is US-based. Regions like Europe and Asia-Pacific are key expansion targets, aided by recent developments such as TTD’s integration of Netflix’s ad inventory in Japan and other global partnerships.

Strategic Initiatives & Developments

Kokai Platform & AI Innovations

Kokai introduces advanced machine learning (Koa) into campaign optimization, and it has seen rapid adoption. Around 75% of all client ad spend is running through Kokai, and the company expects 100% of clients to be using Kokai by year-end. Early results are compelling. Advertisers who transition the majority of their activity to Kokai are increasing their overall spend on TTD 20% faster than those who have not. In aggregate, Kokai has delivered an over 20% boost to key performance metrics for campaigns running on it. The Kokai rollout also includes new applications like Predictive Clearing (to optimize bidding and pacing) and will soon add moment-based targeting for live sports (allowing ads to be bought against key live sports moments) via partnerships with Disney, Sky, etc. Jeff Green was clear to comment on the call that these productivity gains via Kokai should only increase as agencies and brands get more use and as the platform becomes more robust.

Deal Desk

TTD introduced Deal Desk in Q2, a new component of the Kokai suite that is currently in beta testing. Deal Desk uses predictive analytics to analyze and optimize private marketplace deals between advertisers and publishers (and SSPs). It provides insights into how deals are pacing, whether they’re delivering the right impressions, and helps identify and fix underperforming deals. Notably, Deal Desk can suggest open market or premium alternative inventory if a direct deal under-delivers. There is strong interest from both advertisers and publishers in this tool, as the industry recognizes current deal arrangements can be inefficient. Disney was highlighted as an early partner, aligning with Disney’s goal to shift 75% of its ad spend to biddable programmatic channels by 2027. By improving deal outcomes (or routing spend to better opportunities), Deal Desk aims to accelerate the shift of ad budgets from traditional reservation buys to programmatic auctions.

"As more buyers shift toward biddable activation, we're focused on ensuring they have the tools, access and flexibility they need to drive results. Our relationship with The Trade Desk reflects our commitment to meeting advertisers where they are and evolving how we transact to deliver greater efficiency and performance."

Jamie Powers, The Walt Disney Co.

OpenPath

OpenPath enables direct integration with publishers, which saw continued momentum in Q2. OpenPath is designed to create a more efficient and transparent supply chain by letting advertisers connect to premium publishers without unnecessary intermediaries. This has made a lot of people angry, namely, those intermediaries who extract more value than they add. A material amount of total platform spend now flows through OpenPath. The impact for publishers has been significant: the New York Post saw a +97% increase in programmatic display revenue after connecting directly with TTD, among other success stories. These gains illustrate how OpenPath can maximize yield for publishers while giving advertisers clearer pricing and supply information. By providing transparency into fees and auction dynamics, OpenPath helps remove hidden “ad tech tax” layers.

“OpenPath is both a canary in the coal mine and a stalking horse.”

Jeff Green, CEO

OpenSincera

Following TTD’s January 2025 acquisition of Sincera (a data firm specializing in supply chain analysis), the company launched OpenSincera in Q2. OpenSincera is a free online application that shares detailed metadata on the quality of ad inventory across thousands of publisher sites. Anyone in the industry can log in to see transparency metrics (how much of a site’s ad impressions are high quality vs. fraud/suspicious). Since launch, many publishers have used OpenSincera to discover and fix issues in their own ad supply, improving the user experience on their sites. Longer term, TTD is also integrating Sincera’s data directly into its bidding algorithms, reinforcing that spend go down higher-quality paths and filter out inefficiencies. In short, OpenSincera strengthens TTD’s objective measurement capabilities, differentiating its marketplace as one focused on quality and trust (in contrast to opaque walled garden environments, a very important point and more on that below).

Unified ID 2.0 Adoption

TTD continued to champion Unified ID 2.0 (UID2) as an open identity solution for the industry. In Q2, several new partners and platforms announced support for UID2. TTD sees UID2 as critical infrastructure to preserve relevant advertising in a user-controlled, privacy-conscious way. Broad industry adoption of UID2 also reinforces TTD’s position against walled gardens by enabling identity across independent publishers and advertisers.

Competitive Landscape and Differentiation from Walled Gardens

Independence and Objectivity

Unlike Google/Amazon/Meta, TTD does not own any media properties or content inventory. This independence and objectivity is central to its pitch and I believe a significantly undervalued aspect of this business. Bears argue this model could be at risk if premium content is increasingly consolidated behind walled gardens, cutting off access to the open internet. Here is why I don’t believe that: big tech inherently favors their own ad platforms (Google sending budgets to YouTube and Amazon to Prime Video). Because those companies benefit from selling their own ad space, they can introduce biases and lack transparency in how they allocate campaigns. In contrast, TTDs open marketplace has no such conflict of interest.

“If you want to reach your audience with objectivity and with no thumb on the scale across the best of the Internet, you’re more likely to come to The Trade Desk.”

Jeff Green, CEO

TTD doesn’t “grade its own homework,” meaning it relies on third-party measurement and impartial metrics, whereas walled gardens often self-measure their ad performance. If your concerned about transparency and trust in digital advertising, you choose TTD.

“Would you let a media owner grade their homework - telling you which channels drove sales, what to cut and where to invest more?

Would you expect Google to recommend decreasing YouTube spend? Or Amazon to advocate for Walmart Connect?”

Danilo Tauro, PhD, Managing Partner - Aperiam

If you want the stand-up version of this exact thing, watch this.

Transparency and Measurement

TTD has been at the forefront of industry initiatives to increase transparency, such as Unified ID 2.0 and OpenPath/OpenSincera, which have no equivalent in the walled gardens. By championing an open-source user ID and providing visibility into the ad supply chain, TTD positions itself as pro-privacy and pro-transparency, counter to the large closed ecosystems. Regulators in the U.S. and Europe have scrutinized those closed ecosystems (Google antitrust case), which could create opportunities for independent players. Green alluded to this, suggesting that the Google antitrust trial reinforced the drawbacks of a single player controlling both buy and sell sides of advertising. This alignment means TTD succeeds only by maximizing advertiser outcomes, not by favoring any particular publisher’s inventory.

Competitive View on Amazon

Given Amazon’s rapid growth in advertising, Jeff Green spent time differentiating TTD’s offering from Amazon’s. He pointed out that Amazon Advertising’s primary formats (e-commerce search ads and Prime Video ads) do not compete with TTD directly. TTD isn’t in the business of sponsored product listings, and while it would like to access Amazon’s CTV inventory, currently Amazon keeps that mostly inside its walled garden. Most importantly and something that can’t be overstated, Green highlighted a conflict of interest in Amazon’s position: Amazon already competes with the world’s largest brands, which may make these companies wary of sharing data or relying solely on Amazon’s platform. For instance, a large CPG company may be hesitant to put its entire programmatic budget into Amazon DSP because Amazon is a retail competitor and might use that data to its advantage. And by “might,” I mean of course they will! TTD, being independent, is the neutral partner of choice.

“So first and foremost, our strategy has not changed. We give marketers the power and the tools to own and control their own future. And we want them to do that with, of course, the things that have gotten us here, which is full transparency, objectivity and access to the entire Internet.

In my opinion, that is the only way to get large clients to come on your platform and stay there for the long term. And that's why it's always been our focus. And it's why we've constantly and consistently won the trust of the world's largest brands. We have long said that walled gardens, whether it's Amazon or Google, are best suited to buy their own inventory with their own data. But their bias makes it hard for them to buy across the open Internet in a truly objective way.

So when you look at it from that perspective or from a certain perspective, point of view, Amazon is not a competitor, and Google really isn't much of a competitor anymore either. We're trying to buy the open Internet, leveraging technology that values media objectively. We don't have any media, and we don't grade our own homework. In my opinion, and to me, all the data suggests that we're right on this, despite their mixed messages, they are not trying to buy the open Internet objectively.

They can't. They have way too much Prime Video supply to sell to ever honestly pitch large brands to objectively buy the open Internet. They push sponsored listings most and Prime Video after that. Neither of those compete with us, which is why I say that we're not really trying to compete with Amazon. When they argue that their DSP, which is not even their top advertising priority, let alone the core of their business, when they argue that that's objective to the biggest advertisers in the world, I believe they weaken the rest of their advertising pitch, and they weaken the strength of their AWS pitch.

A scaled independent DSP like The Trade Desk becomes essential as we help advertisers buy across everything and that we have to do that without conflict and without compromise. It is my understanding that Amazon nearly doubled the supply of Prime Video inventory in the recent months. That creates a number of conflicts. And in my opinion, it further weakens their already shaky arguments about objectivity.

But if that weren't enough, Amazon already competes with many of the world's biggest advertisers in categories like retail, CPG and cloud, which makes it difficult for those brands to fully trust them as a partner. And when you add in concerns around trust, especially data trust with AWS, it becomes even more challenging for Amazon to credibly position itself as a neutral or even a higher bar, objective platform. We're already seeing the shift as major brands have been reallocating spend toward The Trade Desk for years precisely because of our independence and objectivity. So to be clear, if you insist on calling Amazon a competitor, we compete with a tiny division of Amazon.

We don't compete with Amazon.com or retail. We certainly don't compete with AWS. We compete with whatever small amount of spend goes to the Amazon DSP that isn't spent on Amazon owned and operated. I think Amazon is more of a potential partner, honestly, than it is a long-term competitor. If Amazon opens Prime Video to external demand, which I believe they should, we believe we'd be an amazing partner to drive demand to them, and it wouldn't surprise us if that were to eventually be the course that they choose to take.

But to sum up, while we watch them closely and we know exactly what they're doing, we are playing in a very different sandbox. Ours is focused on decision media, precision, identity and outcomes. They are still primarily focused on pre-negotiated deals that lack an open identity solution like UID2, none of their strategic decisions or investments suggest that they're trying to buy the open Internet objectively or even that that is a priority. I'm very optimistic about where we're headed, especially as the overall TAM continues to grow.

I believe the bigger TAM of advertising will always be pointed at the open Internet, and that's why we're focused on that.”

Jeff Green, CEO