PayPal | The Commerce Platform

A list of every strategic initiative, product innovation, and partnership announcement under new CEO Alex Chriss

Everyone knows PayPal. It was one of the first true fintechs to scale globally. It’s early days produced some of the most innovative and successful entrepreneurs that operate today.

But over time PayPal became perceived as just a payments processor. Innovation slowed, growth stalled and the stock price (and its multiple) has been decimated.

However, heading into Q4 2023, new CEO Alex Chriss stepped in with a bold vision. Re-invent the company as a true commerce platform, bringing together the company as the largest two-sided marketplace in the world. As of the most recent data, PayPal has >430 million active users and >35 million active merchants on the platform. And nearly a quarter of all global e-commerce is transacted through a PayPal owned channel ($1.7 trillion annually).

Chriss has hit the ground running in his first two years as CEO announcing a tremendous amount of new products, bringing in an entirely new leadership team, reducing costs, launching an aggressive share buyback program, and all around building a new company culture focused on innovation and moving fast.

In response to this, the stock has done…nothing. But while the stock is stuck, the core of the company is getting stronger, more profitable, and opening new avenues for growth. In addition, the company is buying back ~8-10% of the outstanding shares annually while the stock trades for around 8x FCF and 12x earnings, providing a very interesting asymmetric idea.

Below I have highlighted many of the company’s product innovations, strategic initiatives, and new partnerships since Chriss took over the company in late September 2023 to highlight how he is transforming PayPal from a payments processor into a comprehensive global commerce platform. Following this are my thoughts on the turnaround and how PYPL 0.00%↑ fits into the Sycamore portfolio.

I. Strategic Initiatives & Platform Evolution

Top-to-bottom foundation reset:

Leadership Reset: Alex Chriss became CEO (Sept 2023), overhauled management, declared 2024 a transition year, and sold non-core units (Happy Returns).

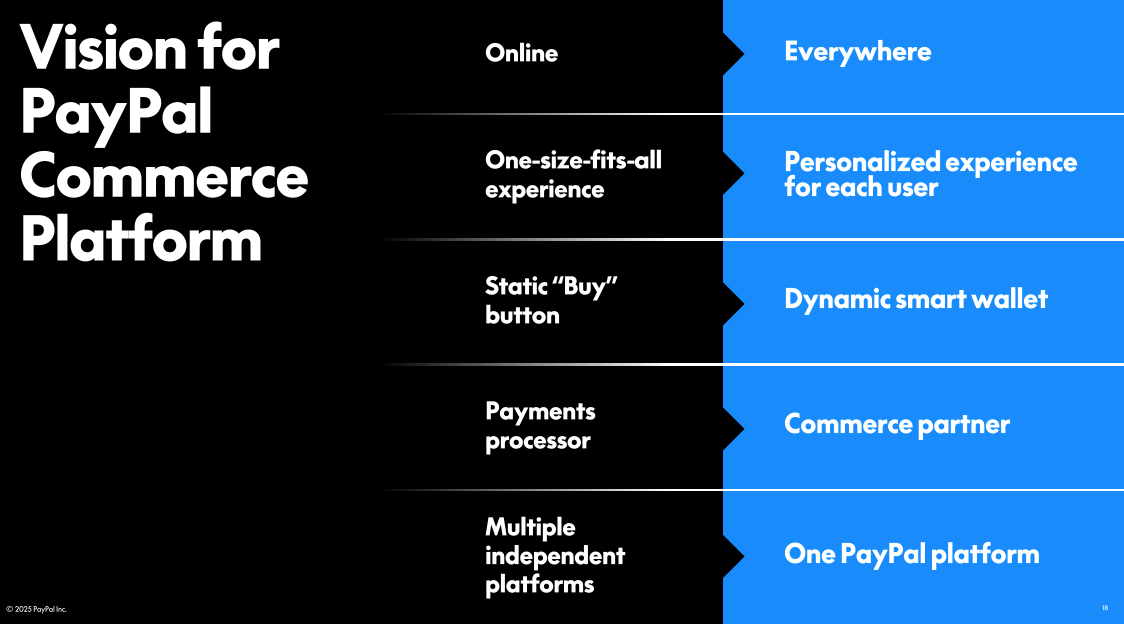

Commerce Platform Vision: Reframed PayPal as a two-sided commerce ecosystem (>430M consumers, >35M merchants).

Cost Discipline: Streamlined operations and reduced expenses to fund innovation.

Brand Campaign: Launched largest U.S. campaign featuring Will Ferrell, refreshed PayPal logo and brand identity.

Stablecoin Push (PYUSD): Expanded use for remittances and merchant accounts; began offering ~4% yield.

PayPal Complete Payments: Expanded all-in-one SMB checkout solution to 25+ countries.

Omnichannel Strategy: Unified online and offline experiences with in-store tap-to-pay, cashback incentives, and Pay Later options.

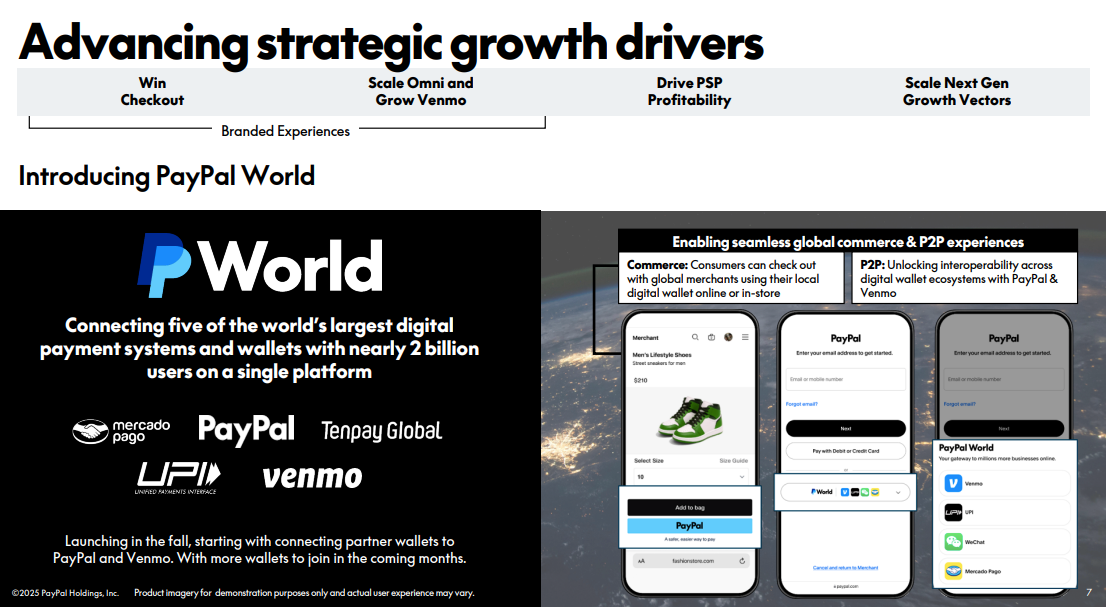

Global Wallet Interoperability: Positioned PayPal World as a neutral, open payments ecosystem enabling cross-border commerce.

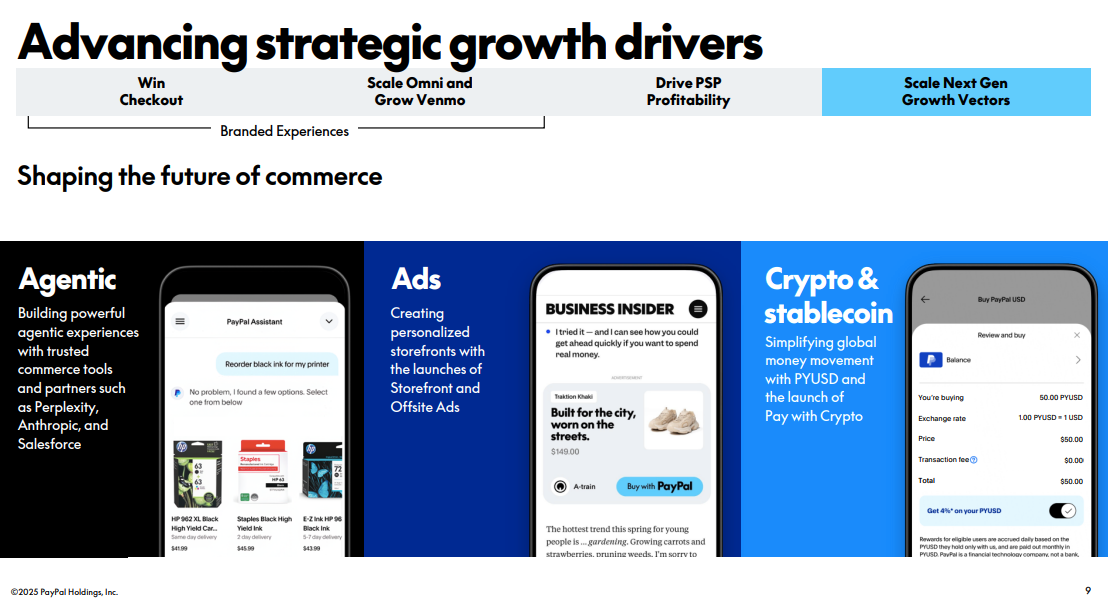

AI & Agentic Commerce: Positioned PayPal as a “smart router” for AI-driven transactions, ensuring relevance in the era of AI shopping agents.

$100M Middle East & Africa Investment - PayPal investing $100m in the Middle East and Africa to support digital growth and entrepreneurs through minority stakes, acquisitions, talent and tech development.

II. Product Innovations & Announcements

A torrent of new consumer and merchant features:

Checkout Redesign: Launched a new PayPal Checkout (passkeys, AI-powered) cutting load times by 50% and halving checkout times.

Fastlane: Introduced one-click guest checkout (~40% faster) and rolled it out to U.S. merchants with adoption by Adyen, Fiserv, and Global Payments.

Smart Receipts: Embedded AI product recommendations and cashback rewards into digital receipts.

Advanced Offers: Launched AI-driven merchant targeting platform.

PayPal Mobile App: Redesigned with cashback and savings features to drive everyday use.

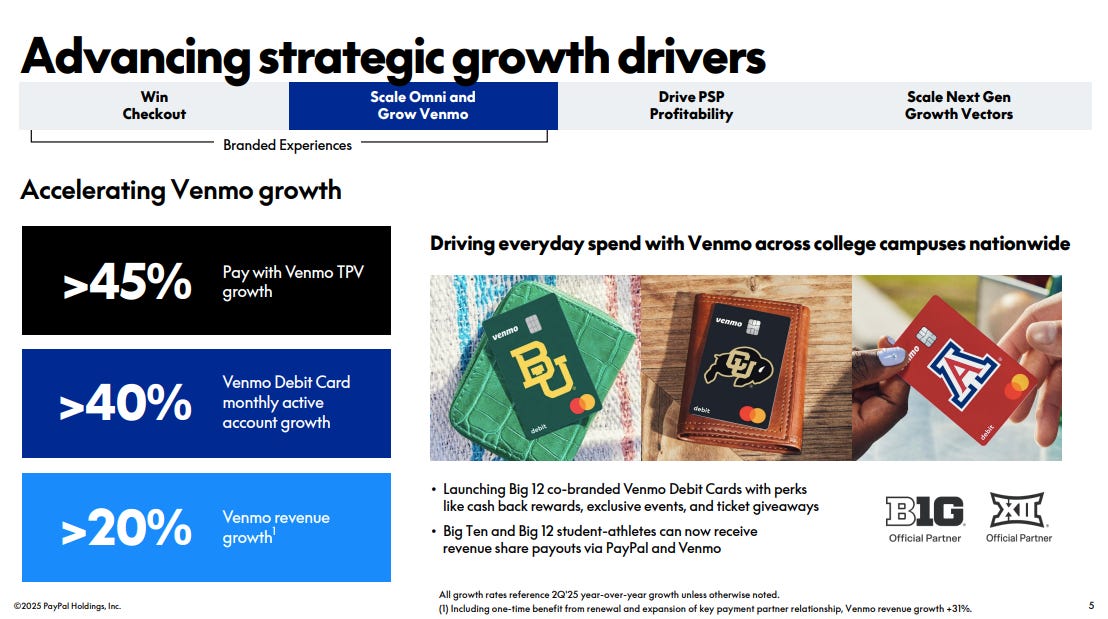

Venmo Enhancements: Improved business profiles, added Tap-to-Pay on mobile, plus group and recurring payments.

Money Pooling: Enabled group collections for gifts, trips, etc.

PayPal Ads: Entered digital advertising with transaction-based targeting and cross-merchant insights.

PayPal Links: Introduced one-to-one payment links (time-limited), with support for crypto and stablecoins coming soon.

Pay Later & Ratenzahlung To Go: Extended installment loans to in-store purchases in Germany.

NFC Wallet: Launched first PayPal mobile wallet in Germany, with tap-to-pay at retail and unified online/offline tracking.

Pay with Crypto: Enabled merchants to accept 100+ cryptocurrencies with instant settlement in fiat or PYUSD, integrated with wallets like Coinbase, MetaMask, Binance.

III. Partnerships & Ecosystem Expansion

Open collaboration and partnership acceleration:

Amazon: Added PayPal as a payment option in Buy with Prime.

Adyen, Fiserv, Global Payments, Shopify: Deepened collaborations to natively integrate PayPal products, including Fastlane and stablecoin payments.

Meta & DoorDash: Embedded PayPal services across platforms.

Best Buy, Lyft, Ticketmaster, Walmart: Rolled out in-app offers with major consumer brands.

Big Ten & Big 12 Conferences: Enabled institutional revenue-sharing payments to student-athletes via PayPal/Venmo; expanded into campus commerce and tuition payments.

Perplexity AI: Integrated PayPal and Venmo into conversational commerce, enabling in-chat payments and launching an Agent Toolkit for AI agents.

If you have a PayPal account you get Perplexity Pro for free. I got mine!

Google: Signed a multiyear strategic agreement embedding PayPal into Google’s ecosystem and advancing “agentic commerce.”

Product Integration: PayPal Checkout, Hyperwallet, and Payouts were embedded across Google services, expanding reach to millions of merchants and users.

Enterprise Processing: PayPal Enterprise became a key card processor for Google Ads, Google Play, and Google Cloud payments, cementing PayPal’s role in Google’s financial infrastructure.

Cloud & AI Collaboration: PayPal moved portions of its infrastructure to Google Cloud and partnered on AI-driven commerce, including Google’s Agent Payments Protocol, to enable transactions through AI agents.

Global Wallet Partners: Announced PayPal World with Mercado Pago (LatAm), NPCI/UPI (India), Tenpay/Weixin Pay (China), bringing interoperability to ~2B wallet users.

“So for all of our PayPal merchants, we just took the addressable market from 400 million to 2 billion, 2 billion users can now click on a PayPal button and make a checkout experience. That’s a branded checkout experience for us with branded economics. … And then we maintain some processing fees as the platform holder as well.

We think this is a great opportunity for us to put a stake in the ground, bring the largest wallets in the world together, and declare we want to be the platform that is creating interoperable wallets around the world.”

Alex Chriss, CEO | Goldman Sachs Communicopia + Technology Conference, September 2025

Blue Owl Capital Partnership - Two-year, multibillion-dollar pact where Blue Owl will purchase roughly $7 billion in loans from PayPal’s “Pay in 4” buy now, pay later.