Nothing is Obvious | Sycamore Portfolio Update [July 2025]

July portfolio update, a new starter position, plus some thoughts on Substack's multi-bagger industrial complex

“There are multi-bagger opportunities under every rock I turn over!”

Pretty Much Almost Everyone with a Paywalled Substack

Click here to view the full disclaimer for Sycamore Capital Management, LLC.

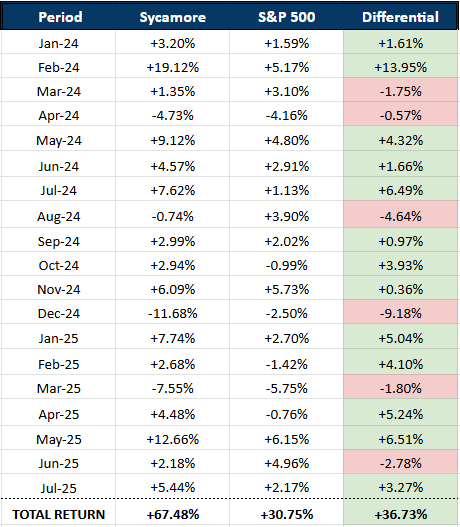

Monthly Returns

Sycamore // +5.44%

S&P 500 // +2.17%

Differential // +3.27%

Year-to-Date Returns

Sycamore // +27.74%

S&P 500 // +7.78%

Differential // +19.96%

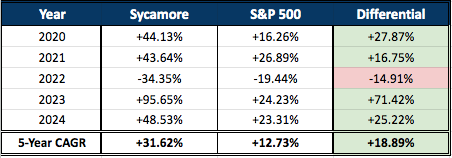

Sycamore Historical Performance

Annual:

Total Return (Simple Sum, Not Compounded) of Monthly Performance Since Launching Sycamore Portfolio Updates:

First Thoughts

Below, I’ll highlight some key developments for my core holdings in July. Otherwise, I’ve spent most of the month looking for new opportunities. I am being patient as I don’t see a rush with indexes at all-time highs and money market still yielding 4%. That said, I have been doing the most work on PoolCorp. I’ve included some initial thoughts below, with a longer post on the business coming soon where I’ll highlight several qualitative factors that make the idea compelling to me.

Perhaps the biggest thing on my mind right now is the sheer number of Substack publishers constantly promoting so-called “obvious” multi-bagger opportunities. I call it the Substack multi-bagger industrial complex. My inbox seems to be a steady stream of subject lines like:

“Under-the-radar Tech Play with 33% Growth - Trading at 2.1x Earnings. I See 8-Bagger in 2-3 Years.”

And…

“Subscribe Before Midnight for Discounted Membership - I Post Weekly 100-Bagger Stock Picks”

Of course, they’re all paywalled. I’m not saying these opportunities don’t exist. But if they do, there certainly aren’t enough of them to write about every week, and cheap stocks are usually cheap for a reason. In short, when it comes to investing, especially as I look around the market right now, nothing is obvious.

As for my work here, I’ll continue researching, publishing as the market and my analysis dictates, and trying to compound at rates above the S&P 500. I don’t have guaranteed multi-baggers. I don’t even have multi-bagger ideas. In fact, I’ve never had a multi-bagger idea. The stocks that have been significant multi-baggers for me (10x and 30x) over the years were never conceived as such. They were great businesses, run by great management teams, that also happened to catch extremely favorable market tailwinds.

Bottom line, there are some really great non-professional analysts and investors on Substack that I truly enjoy following and learning from. But man, it’s hard to scroll through Substack and not start getting a little cynical.

Anyways, onto my almost guaranteed 50-baggers within 18 months…

…just kidding. But seriously, onto the usual monthly portfolio update.